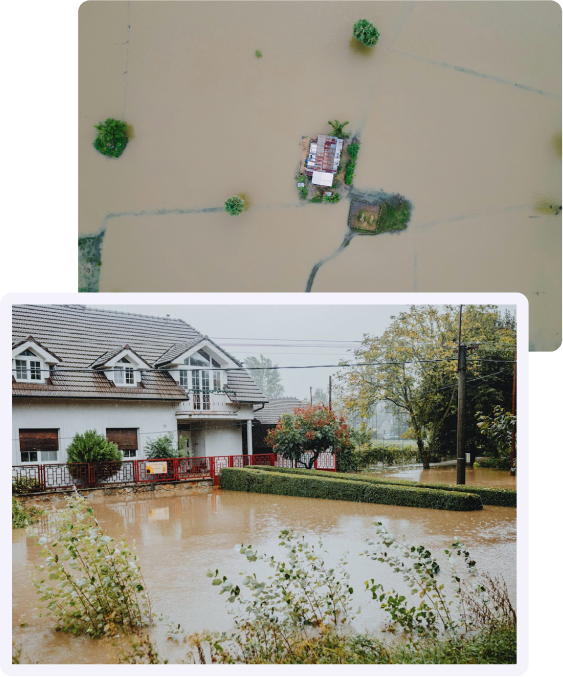

Flood

Our top priority is to protect your family and assets. Flooding, a common natural disaster, is often not covered by standard homeowners' policies. We strive to offer affordable flood insurance to ensure your security in challenging times.

Don't let floods sink your finances - invest in our affordable flood insurance.

Flood insurance is crucial due to the costly nature of floods in the U.S., as they can happen anywhere. Whether you own or rent a property, it's important to consider coverage for your home and belongings. Additionally, homeowners may be required to purchase flood insurance by their mortgage company based on their location.

Highest Quality Insurance at lowest rates available.

Snowy Range Insurance Corp offers personalized services and access to a wide range of flood insurance options to ensure that customers receive the coverage they need in the event of a flood.

Don't wait for disaster to strike – take proactive measures to protect your assets by reaching out to us today. Our team of experts is dedicated to helping you find the most suitable flood insurance policy that meets your individual requirements and financial constraints.

Unlock the Best Flood Insurance Rates

Understanding Flood Insurance Rates

Provides insight into the various factors that can impact flood insurance rates, such as location, property type, and coverage limits, helping homeowners make informed decisions about their coverage.

Comparing Flood Insurance Costs

Compare flood insurance rates to find affordable coverage that fits your needs and budget, protecting your home without compromise.

Budgeting for Protection

Consider budgeting for flood insurance rates as an essential expense for protecting your home and belongings, providing peace of mind in the face of potential flood risks.

Frequently Asked Questions

Flood insurance is essential for homeowners, renters, and businesses in flood-prone areas, as standard policies often do not cover flood damage. It is particularly necessary for those residing in FEMA-designated flood zones and can help protect property and belongings from the financial impact of flood-related losses.

Contacting our agency allows for a swift assessment to identify if your home is in a flood zone. Alternatively, you can consult the FEMA Flood Map to assess your risk.

The cost of flood insurance can vary significantly based on your home's location and the risk of flooding. To determine if your property is in a flood zone, you can utilize the FEMA Map Service.

Without flood insurance, in the event of your home flooding, your options are restricted to seeking grants and loans to cover the expenses of repairing and replacing your home and belongings.

Get in touch today!

Contact us today to get a quote or find out how we can help!

CARRIERS WE REPRESENT

Need to make a claim?

HEAR FROM OUR MOST TRUSTED

Clients & Partners

Climb the summit. Get a quote now.

Insurance for you, your loved ones, and your business.

+1 (303) 674-6688 | kendra@gysinins.com | 27886 Meadow Dr, Evergreen, CO 80439